Two recent transactions in western water (San Diego County Water Authority’s Carlsbad Desalination Plant and San Antonio Water System’s Vista Ridge Project) provide an opportunity to discuss the economics of the structure of debt and equity payments to project developers. For long-lived projects, a finance plan that matches the term of debt structure to the project’s life, makes both debt and equity payments subject to inflationary adjustments and deferred payments at the end of the payment period provides the best economic incentives for:

- customers to conserve water

- project operators to fulfill their contractual obligations

Plans that don’t incorporate these features will shift the economic burden of project costs to future current customers relative to current future customers, erode the economic incentives for customers to conserve water long-term and dilute the economic cost of project operators defaulting on contractual obligations.

Project Financing Structure

The Carlsbad and Vista Ridge projects involve public-private partnerships where project developers design, build, operate and finance the project for their municipal customer. Key aspects of the financial structure of these projects include term of the agreement, term of debt, pricing components for project debt and equity, early buyout provision, and economic penalties for default by project operators and (see table).

Key Features of Carlsbad and Vista Ridge Projects

| Item | Carlsbad Project* | Vista Ridge Project** |

| Term of Agreement | 30 years | 30 years |

| Term of Debt | 30 years | 30 years |

| Pricing Component—Debt | Structured for 2.5% annual increase | Fixed |

| Pricing Component—Equity | Structures for 2.5% annual increase with a target of 9.45% for internal rate of return | Fixed charge with a target of 13.75% for pre-tax internal rate of return |

| Early Buy-Out Provision | Pay outstanding debt and present value of remaining equity payments | Pay outstanding debt and present value of remaining equity payments |

| Penalty for Project Default | Forfeiture of remaining equity returns | Forfeiture of remaining equity returns |

* “Economic Perspective on San Diego County Water Authority’s Carlsbad Desalination Project,” by Rodney T. Smith, Journal of Water (www.JournalOfWater.com), January 2015, pp. 4-8

** “Vista Ridge Regional Supply Project,” by Rodney T. Smith, Journal of Water (www.JournalOfWater.com), February 2015, pp. 3-6

Common features include matching the term of debt to the term of the agreement, early buy-out provisions and penalty for project default. The pricing components for debt and equity charges differ. San Diego County Water Authority structured their charges to increase at an annual rate of 2.5%. San Antonio Water System, instead, choose a fixed annual charge.

Matching the term of debt and equity return to the term of agreement means that the capital investment of these projects is fully repaid within 30 years. The municipal water user has the right to acquire the project after 30 years for $1 in the case of the Carlsbad Project and for no further consideration in the case of the Vista Ridge Project. Both projects involve longer-lived assets. Therefore, provided that they are properly maintained (a contractual obligation of the project developer), these projects are anticipated to provide water service after ownership transfers to the municipal water user. Customers for the first 30 years of project operations will pay the cost of capital investment and customers thereafter will not.

In a world of water conservation, the decline in project costs (which will drive a municipality’s water rates) means that water rates will decline after the transfer of ownership. This distorts the long-term incentive for water conservation. Further, current water customers shoulder 100% of the cost burden of capital investment for the benefit of water customers after the transfer of ownership. I leave for others the political analysis.

The fixed versus escalating debt and equity charges also has significant economic implications. Assuming a long-term rate of inflation of 2.5%, the real (inflation-adjusted) value of a fixed charge will be 22% lower within 10 years, 39% lower within 20 years and 52% lower by 30 years. Again, with real costs declining from the start, the incentive for water conservation will erode over time. Further, for the project developer, the economic cost of project default is also eroded by inflation.

In effect, San Diego’s structuring of its debt and equity charges to grow at 2.5% means that the real value of its debt and equity charges remain unchanged (if actual inflation follows the long-term average). In comparison to a fixed charge without escalation, San Diego shores up the long-term economic incentive for water conservation. Further, San Diego assures that the economic cost of a project developer’s default is not eroded by inflation.

Illustration of Issues

Most water users face the prospect of new projects that yield water at costs substantially higher than their current sources of water supply. As projects are undertaken to meet growing demands, increased supply reliability, sustainability and other objectives, it would be prudent to communicate the economic costs through permanent increases in water rates, rather than a structure where, long-term, the economic incentives for water conservation are diminishing and eventually go away.

I use the following example to illustrate the nature of the issues and their solution:

- Project yield: 50,000 AF annually

- Capital investment: $1 billion

- Debt/Equity Mix: 80%/20%

- Term of Debt: 30 years

- Interest rate: 5%

- Target Internal Rate of Return for Equity: 10%

- Term of Project Agreement: 30 years

- Project useful life: 50 years

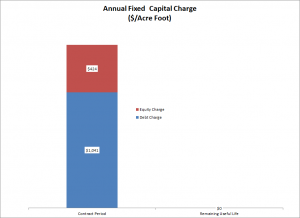

Amortizing capital investment over the 30-year term of the agreement generates a $1,041 per acre-foot annual debt charge and a $424 per acre-foot annual equity charge for a flat total annual capital charge of $1,465 per acre-foot (see chart). Since capital investment is fully paid during the term of the 30-year agreement, the cost of water from the project falls by $1,456 per acre-foot after the ownership transfer. For capital intensive water projects, such as the Carlsbad Project and the Vista Ridge Project, this represents a significant price reduction after ownership transfer.

If one were to amortize the capital investment over the project’s 50 year life, the annual debt charge would fall to $824 per acre-foot and the annual equity charge would fall slightly to $403 per acre-foot for a total annual capital charge of $1,227 per acre-foot for the entire useful life of the project. (The proportionately small impact on the equity charge reflects the higher return, 10%, paid on equity relative to the 5% interest rate paid on debt.)

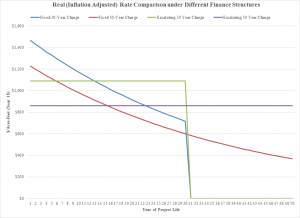

Inflation, of course, will erode the real economic value of these capital charges (see chart). Inflation reduces the real value of the capital charges, whether capital is repaid over 30 years or 50 years. Extending the recovery of capital charges over the useful life of the project at least provides some incentive for water conservation after ownership transfer.

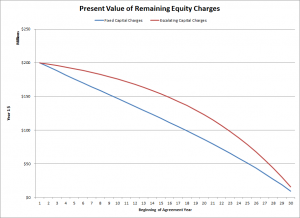

The agreements for long-term project define project developer obligations regarding standards of service and performance. Agreements list the potential causes of default (failure to meet contractual obligations). Project developers will have a period to “cure” their defaults. Once the cure period has passed, the agreements allow the municipal water user to take over the project. While they must pay debt and other third party costs (to assure those parties do not suffer economic losses from the project developer’s default), the municipal provider does not make any further equity payments due to project developer. As a result, the economic cost of default for the project developer is the present value of the remaining equity payments at the time of default.

The figure below shows how the present value of remaining equity payments varies with the years remaining on the agreement and whether annual equity charges are fixed or escalated. In this example, equity financing paid for $200 million of the project’s capital investment. At the beginning of the first agreement year, the present value of the remaining equal charges equals $200 million under both fixed and escalating annual charges (i.e. the schedules are financially-equivalent). The cost of default by the project developer falls considerably faster for fixed annual charges than escalating annual charges. By year 10, the value of remaining fixed equity charges is $147 million (Year 1 $) and the value of remaining escalating equity values is $176 million (Year 1$). By agreement year 20, the value of remaining fixed equity charges is $86 million (Year 1$). The value of remaining escalating equity charges is $123 million (Year 1$).

In sum, for any year during the agreement, the project developer has more “skin in the game” to avoid default under financially-equivalent escalating equity charges than fixed equity charges.

What To Do

How can one structure financing of a 30-year agreement for a 50-year project and avoid capital charges falling after ownership transfer, maintain the economic incentive for water conservation and provide meaningful economic incentives for project developers to meet their contractual obligations?

The key involves structuring “balloon” payments at the end of the agreement for both debt and equity. Corporate debt, for example, often involves the issuance of “interest only” payments during the term with a balloon payment equal to the amount borrowed. When the debt comes due, the corporation “rolls over” the debt through new debt issuance.

Since a water project has a defined life, 50 years in this example, one does want not to finance with “interest only” debt. A portion of the debt should be repaid during the first, 30-year debt issuance. The balance paid by subsequent rollover financings. In this example, I assume that there is a 20-year subsequent financing of the debt left unpaid by the first financing.

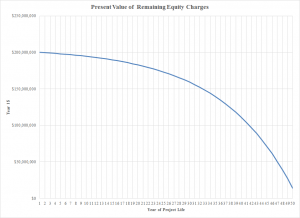

A solution is to issue inflation-adjusted debt and structure equity charges. The payment structure could span the useful life of the project. For a debt issuance of 30-years, the unpaid principle would be “rolled over” into a subsequent financing that would repaid over the remaining useful life of the project. If the municipal water user wants to buy out the project developer after 30 years, they pay an acquisition fee equal to the present value of the remaining equity charges year 31 through 50. Under this example, almost $600 million of debt is retired through the first debt financing, the balance of the $800 million debt obligation retired through the second debt financing, and the equity buy-out at the end of the 30th year is $156 million (Year 1$)—see table.

Debt Retirement and Back-End Equity Buy Out under Proposed Financial Structure

|

Item |

Amount |

| Debt Retired by First Debt Issuance |

$588 million |

| Debt Retired by Second Debt Issuance |

$212 million |

| Equity Buy-Out at End of 30th Year |

$156 million (Year 1$) |

Under this structure, the capital charge would be $859/AF (Year 1$), made up of a debt charge of $557/AF (Year 1$) and an equity charge of $301/AF (Year 1$). If the escalating charge were levied only over 30 years, the capital charge would be $1,091/AF (Year 1$), made up of a debt charge of $758/AF (Year 1$) and an equity charge $333/AF (Year 1$). The proposed structure (50-year escalating charge) yields a constant inflation-adjusted price over the entire project term (see chart).

Before offering comparisons, all these rate structures are financially-equivalent (they yield the same present value–$800 million for debt payments and $200 million for equity returns). They differ in terms of their dynamics in pricing.

In comparison to the proposed structure, the fixed 50-year charge is more expensive for the first 15 years, the fixed 30-year charge more expensive for the first 23 years and the 30-year escalating charge more expensive for the first 30 years. After these respective benchmark years, the alternative rate structures are cheaper. However, they erode the economic incentive for water conservation and project developers meeting contractual obligations.

The proposed structure also provides project developers with strong economic incentives to meet their contractual obligations (see chart). At the beginning of the project operations, the present value of remaining equity charges equals $200 million. By stretching out the repayment over 50 years, the project developer has a lot more “skin in the game” for decades. By year 30, there is about $150 million of equity charges (Year 1$) remained to be earned by meeting contractual obligations. If the municipality wants to buy-out the project developer in year 30, then the acquisition price would be the present value of remaining equity charges provided, of course, that the project developer met their contractual obligations.

How would the municipality pay for this acquisition? By maintaining the pricing structure post-acquisition, the municipality has an inflation protected income stream from the remaining equity charges. This payment stream could finance issuance of securities to finance the acquisition.

Concluding Thoughts

Financial structure should reflect the economics of projects, not distort them. Long-term projects supported by long-term charges provides superior economic incentives than project that do not. For long-lived projects, the tendency to structure debt charges to reflect the term of debt and structure equity charges (on a level basis) for the term of a project agreement distorts the economics of the project. The economic incentives for water conservation are eroded by inflation or payout periods shorter than project life. The economic costs of project default are also weakened.

Instead, a financial plan should envision a succession of debt issues with rollover of a portion of previous debt and structured equity charges that has a significant back-end of payments to project developers to reward contractual performance. By making both debt and equity payments subject to inflationary adjustments, the project’s rate structure can successfully communicate long-term project costs to customers and economic incentives for meeting contractual obligations by developers.