How did the Colorado River Basin states’ economic recovery from COVID-19 perform? Understanding the outcome will shape the future circumstances of the management of the Colorado River.

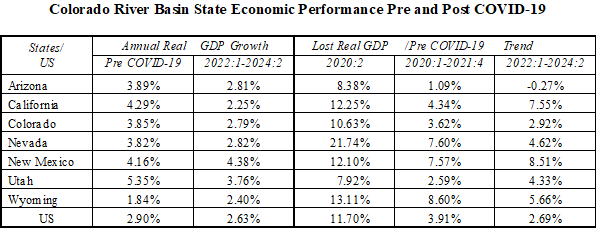

The table below presents key findings:

- Estimates of real GDP growth pre COVID-19 versus the 1st quarter of 2022 through second quarter of 2024 (the onslaught of economic malaise at the national level)

- Estimates of lost real GDP for the 2nd quarter of 2020 (the depth of the national economic downturn), for the 1st quarter of 2020 through 4th quarter of 2021 (the “v-shaped” recovery period), and the 1st quarter of 2022 through 2nd quarter of 2024 (the onslaught of economic malaise at the national level).

See Part 5: Deconstructing the Impact of COVID-19 on Each Colorado River Basin State for state specific figures and future discussion. There are five takeaways.

First, Colorado River Basin states generally grew faster than the United States economy pre COVID-19. Only the State of Wyoming grew slower at a rate of 1.84% versus the US rate of 2.90%. Utah, California, and New Mexico were the three fastest growing states followed by Arizona, Colorado, and Nevada.

Second, during the economic malaise since the 1st quarter of 2022 (see Part 1), growth of Colorado River Basin states has been a mixed bag. Economic growth in California and Wyoming has lagged the growth in the national economy, although Wyoming’s growth rate has increased relative to its low growth rate pre COVID-19. Growth among the other larger Colorado River Basin states (Arizona, Colorado, and Utah) has been faster than the national economy. New Mexico remains the fastest growing Colorado River Basin state. The growth in Nevada rivals the growth in Arizona and Colorado.

Third, at the depth of the downturn in the national economy (2nd quarter of 2020), only Utah and Arizona suffered smaller losses in their real GDP than the United States generally. Nevada suffered the most severe losses, undoubtedly due to its economy’s dependency on tourism. After second place Wyoming, California lost 12.25% of real GDP during the dark 2nd quarter of 2020.

Fourth, during the “v-shaped” recovery period (1st quarter of 2020 through 4th quarter of 2021 discussed in Part 1), Arizona, Utah and Colorado averaged the smallest reductions in their real GDP, 1.09%, 2.59%, and 3.62% respectively, versus the national loss of 3.91%. California averaged a larger loss of its real GDP (4.34%) than the national economy followed by New Mexico, Nevada and Wyoming.

Fifth, Arizona is the only Colorado River Basin State resilient to economic malaise since the 1st quarter of 2022. (In fact, Arizona’s real GDP averaged slightly above pre COVID-19 trend growth). Colorado and Utah are experiencing smaller losses of their real GDP than Nevada, the second-best performer in the Lower Basin. California’s performance finds a sister state in New Mexico. Wyoming is in the middle of the pack. See Part 5 for further discussion.

In sum, Arizona, Colorado and Utah are now the most robust economies in the Colorado River Basin. California is the least among the larger states and, arguably, on the verge of further decline. These economic dynamics are enhanced by migration from California to other states including the three major resilient Colorado River basin states (Arizona, Colorado, Utah), as well as Florida, Texas and somewhat (at least for the music industry) Tennessee. The different impact of COVID-19 on the Colorado River Basin states undoubtedly reflects differences among the states in their different economic bases as well as their COVID-19 and other policies (e.g., “business climate”).

As discussed in Part 3, the impact of the COVID-19 economic recovery will require us to rethink how to address the over appropriation of the Colorado River.